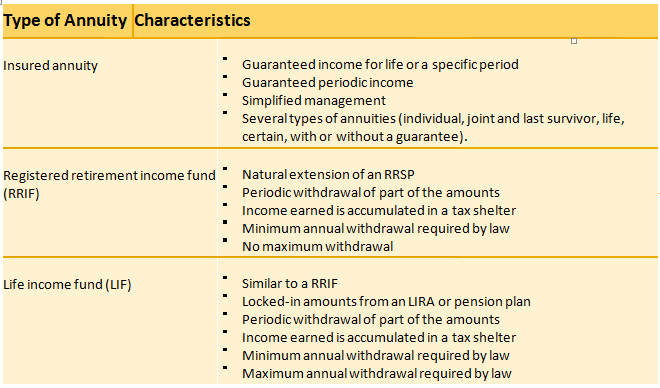

Under the regulations, an RRSP must be converted to a registered retirement income fund (RRIF), or another retirement income instrument by December 31 of the year you turn 71.

Tax-Free Savings Account (TFSA)

The Tax-Free Savings Account (TFSA) is the most exciting innovation in personal savings since the creation of the Registered Retirement Savings Plan (RRSP) by the government of Canada.

The TFSA is a unique tax-free savings program (non-RRSP) now offered by Industrial Alliance to help you:

- Accumulate more savings to pursue personal projects, TAX FREE

- Place income generated by invested sums (existing investments,investment income, inheritances, donations, etc.) in a tax shelter account

- Maximize your savings with retirement in mind

Advantages of the TFSA

If you’re a Canadian resident age 18 or older, you can benefit from a savings account that offers the following advantages:

Simple and accessible

You can contribute up to $5,000 annually in a tax-free account, regardless of your income.

Tax free

Any earnings generated (interest, capital gains or dividends) in the TFSA, as well as sums withdrawn, are not taxable.

Cumulative contribution room

Unused annual contribution room accumulates indefinitely.

Ease of withdrawals

You can withdraw any amount at any time without penalty. *There is no restriction as to the use of withdrawals.

Ideal complement to an RRSP

The TFSA investment instrument complements an RRSP as an efficient way to save and put more money toward your retirement.

No affect on income-based government benefits

Neither TFSA contributions nor its earnings affect eligibility for the Guaranteed Income Supplement, Old Age Security, the Canada Child Tax Benefit or other government benefits based on income.

Wide range of investments

You have the freedom to choose the funds—daily interest, guaranteed interest and a wide range of segregated funds—that reflect your needs.

Practical income-splitting tool

A couple can contribute to two TFSAs even if one of them has no income.

Collateral assignment

It’s possible to assign the assets of a TFSA as collateral for a loan.

(RESP) Education Savings Plans

Children give us a reason to live and a thousand reasons to hope. And also a desire to provide them with all the tools they need to succeed personally and professionally.

Build up a tax-sheltered fund to finance a child’s postsecondary education. A registered education savings plan (RESP) is the ideal financial vehicle to meet the job market’s education requirements and help you defray mounting education costs.

Who Should Consider an RESP?

Any person who is concerned about the future of a beneficiary (generally a child)

You may designate a child, grandchild, nephew, niece, etc. as the beneficiary of an individual plan. There is no restriction on the relationship between the child and you.

For family plans, beneficiaries must be related to the subscriber by blood or adoption.

Features and Advantages

An RESP is made up of subscriber contributions, eligible government grants, and investment income.

Beneficiaries obtain an tax deferral on their investment income.

To help you build the most valuable nest egg, you may be eligible for various grants for which we can apply on your behalf. (Click here to learn more about government assistance programs.)

When the big day comes to start postsecondary studies, beneficiaries will receive their educational assistance payments to support them in their future success.

The plan’s flexibility allows you to change beneficiaries.

Canada Education Savings Grant (CESG)

Human Resources and Skills Development Canada (HRSDC) provides an incentive for parents, family and friends to save for a child’s post-secondary education by paying a grant based on the amount contributed to an RESP for the child. The CESG money will be deposited directly into the child’s RESP